| 开始买入UNG |

| 送交者: 2012年12月17日20:17:26 于 [世界股票论坛] 发送悄悄话 |

|

|

|

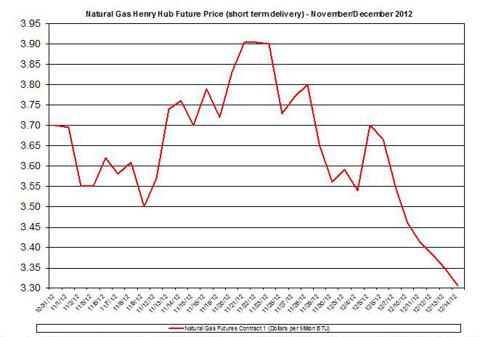

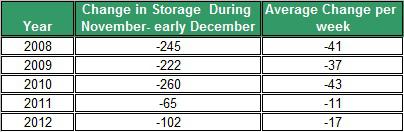

The price of natural gas (short term delivery) plummeted during last week. The recent fall may have been due to the unseasonably high temperatures that resulted in the natural gas storage remaining nearly unchanged. Will natural gas continue to decline? Let's analyze the recent developments in the natural gas market. During last week, the future price of Henry Hub (short term delivery) tumbled down by 6.85%. Moreover, United States Natural Gas (UNG) also plummeted by 7%. Current Henry Hub future prices are nearly $0.02 per Mil. BTUs above natural gas price for the same week in 2011. The recent tumble in the price of natural gas, may have contributed to the recent fall in major natural gas and oil producers' stocks such Chesapeake Energy Corporation (CHK): During last week, shares of the company fell by 4%. The chart below presents the changes in the price of natural gas during recent weeks. As seen, natural gas prices have had a sharp downward trend in the past several weeks. Storage According to the latest EIA weekly update, the underground natural gas storage remained virtually unchanged as it rose by 2 and reached 3,806 Bcf. The current storage for all lower 48 states is 8% above the 5-year average and 1.3% above 2011 storage. In other words, there was no sizable extraction as it tends to occur during this time of the year. Demand From the demand side, during last week, the average U.S NG consumption hiked by 14.7% but was still 14.4% lower than the same week last year. The residential/commercial sector led the rise with a 28.9% gain (week over week) but was also 19.8% lower than last year. Moreover, the power sector's NG demand also rose by 7% (week over week). Finally, the industrial sector's demand increased by nearly 1.9% (W-o-W). As a result, the total demand for NG increased by 14.5% compared to last week. Finally, the total demand was still 13.9% below the demand during the same week last year. This means, even though the demand for natural gas hiked last week it remained relatively (to last year) low. Supply From the Supply side, the gross natural gas production declined by 0.7% during last week; it was still 1.6% above the production in 2011. Conversely, imports from Canada also rose by 1.3% (week-over-week); the imports were still 19.2% lower than the same week last year. The total U.S natural gas supply slipped on a weekly scale by 0.44%. Therefore, the NG supply slightly contracted last week. According to a recent report, the natural gas rotary rig count edged down by 1 and reached 416 rigs, according to Baker Hughes. The ongoing decline in number of rigs could suggest a slow contraction in natural gas production. So during last week, the natural gas supply slightly contracted while the demand sharply rose. Compared to last year, however, the demand is still very low while the supply is only slightly below last year's level. Thus, the natural gas market has slightly tightened compared to last week but loosened compared to the same time last year. Seasonality During the first weeks of December the extraction from the natural gas storage tends to rise. Therefore, last week's report on storage, in which the total storage remained almost unchanged isn't common for the season; the injection in the Producing Region is among the factors for the storage remaining nearly unchanged. The table below presents the changes in storage during November and early December (for six weeks) in the past five years. Despite the low movement in storage last week, the total extraction was still higher than last year but much lower (nearly by half) than the total extraction in each of the preceding years to 2011. If the storage will continue to dwindle at a much slower pace than in the previous years, this could continue to drag down natural gas prices. Warmer Weather Up Ahead During the previous week, the U.S temperatures (on a national level) were 9.3 degrees warmer than the 30-year normal temperature and 8.4 degrees warmer than the same week in 2011. Rain and thunderstorms are projected to reach the South and snowfall may occur in the Northeast region. Nonetheless, the current projections are for warmer temperatures for the season. Many estimate that if the weather will remain warmer for the season this could adversely affect the prices of natural gas. So what's next for natural gas? The natural gas storage remained virtually unchanged last week and if the weather will continue to be warmer than normal, the storage might dwindle at a slower pace than in previous years. The uncertainty around the type of winter forthcoming and how warm it will be in January-February is keeping natural gas from bouncing back. Nonetheless, there seems to have been a shift in the weather forecast as more people speculate this winter might be warmer than normal. The expected warm weather in the days to come could further lower the demand for natural gas, which could ease the price pressures from the demand side. Moreover, natural gas production remained stable and thus lowers the price pressures from the supply side. Therefore, the price of natural gas might continue to decline in the near future. If this winter will be warmer than normal, then this could pull down the price of natural gas well below the $3 mark, as was the case last year. |

|

|

|

||||||||||

|

|

| 实用资讯 | |

|

|

| 一周点击热帖 | 更多>> |

| 一周回复热帖 |

| 历史上的今天:回复热帖 |

| 2011: | 可能为美股下一波多头行情奠定基础。 | |

| 2010: | 泡兄今天如何走棋? | |

| 2010: | my itmn .... | |

| 2009: | 金融风暴(电箱书记布置的作业) | |

| 2009: | 碳政治”新型国际政治与中国的战略抉择 | |