| Don't Wait For The Robins |

| 送交者: 2012年07月18日16:24:20 于 [世界股票论坛] 发送悄悄话 |

|

|

|

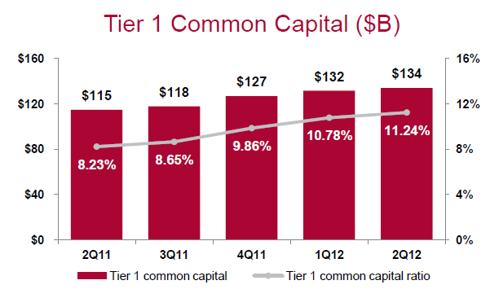

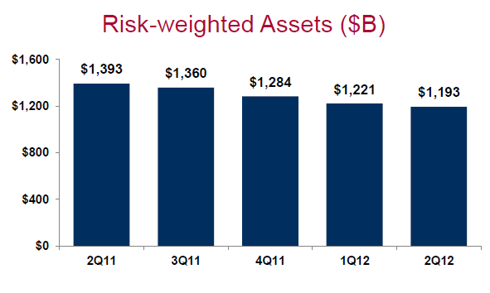

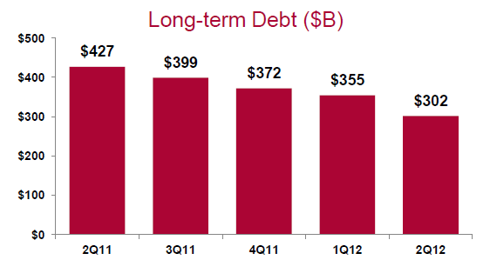

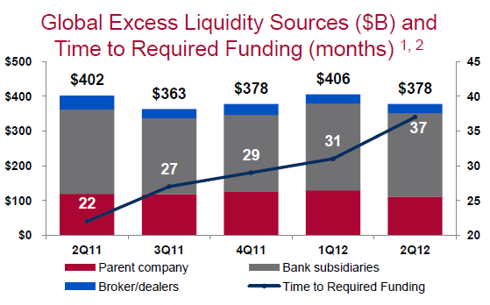

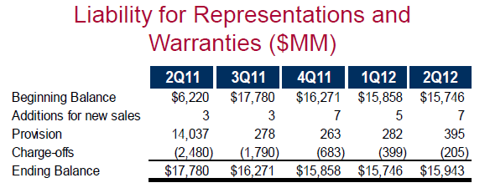

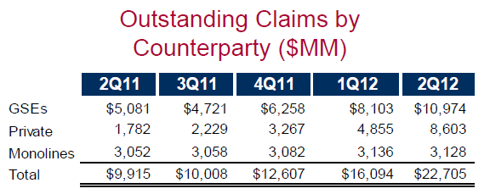

On July 18th Bank of America Corp (BAC) reported earnings reflective of a very difficult 2nd quarter. For all banks with Capital Markets businesses revenue contraction has hurt both the top and bottom lines. In addition to facing significant macroeconomic headwinds the banking industry is undergoing the most aggressive regulatory transformation since post The Great Depression, which is resulting in radical changes to both balance sheets and business models. Despite these difficulties, the extreme pessimism and negativity surrounding the sector has created one of the most obvious and potentially richly rewarding investment opportunities of my lifetime. Bank of America under the strong leadership of Brian Moynihan offers one of the best ways to play a recovery in the U.S. economy with a strong margin of safety and explosive return potential. Net Income for the quarter was $2.5 billion or $0.19 per diluted share. This income, plus the realization of some of Bank of America's deferred tax asset (DTA), and a $27.4 billion decline in risk-weighted assets boosted Bank of America's estimated Basel III Tier 1 Common Capital ratio to 8.1%. This materially exceeded Bank of America's earlier estimates to get to 7.5% by the end of the year, and is indicative of the excellent job Moynihan and his team has done to tackle the problems that are under the bank's control. The Tier 1 Common Capital Ratio improved 46 basis points from the end of the 1st quarter to 11.24%. These improved metrics should accelerate the company's ability to return money to shareholders through buybacks and dividends pending the next CCAR review. Bank of America has five business segments that have been showing steady improvement up until this quarter. The difficulties this quarter have much more to do with the macro than any real misfires specific to the company. Consumer & Business Banking (CBB) posted net income of $1.2B which was $299MM less than the 1st quarter. Consumer Real Estate Services (CRES) has been the company's primary problem child and once again posted losses of $768MM in the quarter, which were $377MM less than the losses in the 1st quarter. Global Wealth and Investment Management (GWIM) had net income of $543MM that was just $4MM lower than the 1st quarter. Global Banking income of $1.4B decreased $184MM from Q1 2012, and Global Markets $462MM in net income was $336MM less than the prior period. Corporate losses were $336MM in the quarter. These abysmal results are not reflective of the true earnings power of Bank of America, and it is really a reflection of Bank of America's aggressive cost cutting initiatives that have enabled the company to remain comfortably profitable. Extremely low net interest margins really hurt Bank of America's results across their business lines. To combat the issue the company has been concentrating on lowering the liability cost structure. Long-term debt has shrunk by a remarkable $125 billion over the last year. Despite this huge decline in debt balances the company has been able to maintain its near record levels of excess liquidity. The retirement of long-term debt reduces interest expenses but pressure will remain as the year progresses, and only when interest rates do eventually rise will the net interest income really see dramatic growth. Further complicating the net interest margin issue are the changes to Basel III regulatory requirements. Due to stringent requirements on risk-weighted assets (RWA) Bank of America has been shrinking the consumer loan portfolio at a greater rate than it is increasing the business banking portfolio. The drop in consumer loans looks even greater due to Bank of America's exit from the correspondent mortgage channel. While losing market share is not a fun thing to go through it was undeniably necessary for Bank of America to right-size and de-risk the balance sheet to cope with this new era of banking regulations. Bank of America believes that the company should generate about $10.25 billion in net interest income before the positive impact from liability management actions. Credit quality continues to improve with non-performing loans, leases and foreclosed properties declining to $25.38B from $27.8B in Q1. The non-performing loan ratio is down to 2.87% from 3.1%. The allowance for loan and leases ratio is still very strong at 3.43% in Q2 versus 3.61% in Q1. The allowance for loan and lease losses to annualized net charge-off ratio was 2.08 times in the 2nd quarter compared with 1.97 times in the 1st quarter. Pre-tax pre-provision earnings of $5.2 are well below the company's potential, largely due to the weak quarter in capital markets, and the still elevated expense structure needed to combat legacy mortgage costs and litigation. Bank of America's exposure to Europe is very manageable. Total exposure to the GIIPS, including net credit default protection, declined to $9.6 billion at June 30, 2012 from over $16.7 billion last year at the same time. The biggest risk particular to Bank of America is the company's exposure to litigation due to its disastrous Countrywide acquisition. Outstanding claims by counterparties increased to $22.7 billion from $16.1 billion in the previous quarter. The company only increased its liability for these claims by $205MM. A big reason for this is that Bank of America is contesting claims made by the GSEs relating to loans which the borrowers have made at least 25 payments. While I can certainly understand Bank of America's argument I'd assign a reasonably high probability that additional liabilities for reps and warranties towards the high end of Bank of America's $5 billion worst case estimate of additional liabilities are likely to be realized over the next year. To put this into context though Bank of America's market capitalization at a $7.53 stock price is only $81.1 billion, versus common equity of $215.5 billion. Where are $134.4 billion of losses going to come from including any write downs of intangibles? Tangible book value and book value grew to $13.22 and $20.16 on June 30, 2012, from $12.87 and $19.83 respectively at the end of the 1st quarter. While revenue growth will invariably come when macroeconomic conditions perk up, and the adjustment to Basel III is consummated, astounding expense reductions will drastically improve profitability over the short term. Moynihan earmarked $5 billion of annualized expense reductions in phase 1 of New BAC, and the company says that they have achieved over 20% of that thus far this year, with the rest to come over the next several years. Now the company has identified another $3 billion in annual expense cuts in phase 2 of New BAC which hare expected to be completed by mid-year 2015. In the 2nd quarter non-interest expenses declined to $17 Billion from $19.1 Billion in the 1st quarter. Once these cost savings plans are fully implemented Bank of America will have reduced non-interest expenses by another $7 billion per year. Expenses are expected to decline sequentially particularly as the mortgage servicing problems are now at the later stages, meaning that the company will be able to shed many of the temporary employee costs pertaining to these issues. While Bank of America has a long way to go, I've been very pleased with Brian Moynihan's efforts to clean up the company. Tackling the capital and expense issues has been imperative, and moving forward profitability will most certainly improve in my opinion. Bank of America should trade at tangible book value at the very minimum and within 3-5 years I'd expect the company to be in the low 20's with an extremely attractive dividend yield. Any resolution on litigation and reps and warranties exposure will likely serve as a potent catalyst, as investors can then focus on the transparent improvements in the business and risk profile. See my original article Bank Of America: Don't Wait For The Robins |

|

|

|

|||

|

| 实用资讯 | |

|

|

| 一周点击热帖 | 更多>> |

| 一周回复热帖 |

| 历史上的今天:回复热帖 |

| 2011: | 金融市场200年 | |

| 2011: | 今天开盘时动量还可以,后来弱了些,最 | |

| 2010: | 欧洲债务危机或显现曙光 | |

| 2009: | 讨论一下,奥巴马的经济刺激计划到底解 | |

| 2009: | 仙子、太郎能不能也给我来个妹儿? 有在 | |