Summary

- EIA Drilling Productivity Report for May forecasts natural gas production in the seven largest shale basins will decline overall by 23 million cubic feet per day.

- According to the EIA, all of the growth in natural gas production in the lower 48 has come from the seven shale basins followed in the report.

- The report is based on the average rig count for the month of March. The rig count has fallen by more than 10% from the March rig count average.

Based on the recently released EIA Monthly Drilling Productivity Report, the EIA will soon be lowering their forecast for 2015 natural gas production from the lower 48 United States. The report now predicts natural gas production will decline overall by 23 million cubic feet per day in May from the seven shale basins followed in the report. According to the EIA, all of the growth in natural gas production in the lower 48 has come from the seven shale basins followed in the report. Natural gas production has already been declining from the regions not followed in the report. So, overall natural production in May can be expected to fall by more than 23 million cubic feet per day.

This upcoming change in the forecast was originally predicted in January in my article Falling Rig Count Could Cause Natural Gas Production Decline. That article explains the EIA's methodology used in the report. At that time, the article showed that the rig count needed to fall by an additional 25% before natural gas production would flatten out. The rig count is now down over 35% from mid-January. By all indications the rig count can be expected to fall further from here, unless there is a sharp rebound in oil and natural gas prices.

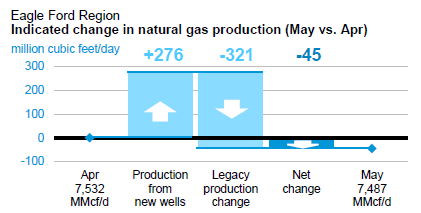

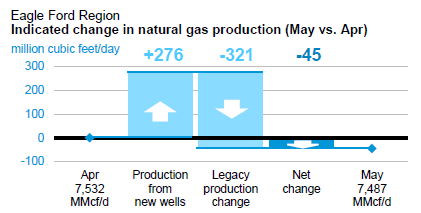

Here is a look at the Eagle Ford natural gas production forecast for May:

The EIA forecasted natural gas production from the Eagle Ford Region would be growing by 97 million cubic feet per day in February. Now, they are forecasting natural gas production from the Eagle Ford Region will be declining by 45 million cubic feet per day in May. If the rig count average for March flattened out, natural gas production would still show a further decline in June versus May. That is because there are not enough rigs drilling to replace the Legacy production from existing wells.

However, the rig count for the Eagle Ford in the March 13 Baker Hughes Report was 146 rigs. As explained in the referenced article above, the EIA uses the average rig count for March to estimate the production for a basin for May. In the latest report released April 10, the rig count for the Eagle Ford fell to 125 rigs. Unless there is a sudden reversal in the rig count, the EIA will forecast an even greater decline in natural gas production from the Eagle Ford for its June estimate.

Investors have a chance to catch a potential near term bullish move in natural gas prices based on the EIA revising down their natural gas production forecasts. Right now the EIA is estimating there is 3.1 Bcf per day in excess natural gas production versus normal demand. The details of the EIA's position can be found in the article EIA May Soon Lower Natural Gas Production Forecast. Based on flat production growth during the 2015 injection season averaging 73.3 Bcf/d, the EIA estimates prices at the Henry Hub will need to average $2.39 to encourage enough coal-to-gas switching to keep storage at 3.9 Tcf at the end of the storage season, assuming normalized weather.

But those EIA estimates are based on a 20% higher rig count. Soon the EIA will change its production forecast. They will also change their price assumptions based on the need to reduce coal to gas switching. This could move natural gas prices back into the mid-$3 range, maybe higher. If the rig count continues to fall, then prices will need to rise to a level to encourage more rigs to enter the dry gas production fields. That may require a price above $4, and maybe above $5. The key is to watch the rig count.

There has been a lot of focus by articles on the potential fall in U.S. oil production, but little attention has been paid to natural gas. Oil prices are determined globally, but almost all of the natural gas consumed in North America is produced in North America. Shortages will occur, creating huge price spikes unless someone in North America drills for enough natural gas. The bearish prices for oil are actually bullish for natural gas prices because of the drop in associated gas from new oil wells.

One thing to consider is that when the rig count was double what it is now, prices were 80% higher than they are now. But companies were still borrowing money and issuing equity to supplement cash flow in order to drill. Prices are currently down 40%, but cash flow is reduced by more than 40% because it still costs a similar amount of money to operate leases and ship the products. The potential exists for the rig count to continue to fall as Wall Street has lost its appetite to debt finance new drilling at current prices. Before long natural gas traders may start focusing on the release of the rig count rather than last week's storage number, or the latest 10-day weather forecast. The market has yet to recognize the rig count is where the real story is being told.

ETFs To Which Natural Gas Fundamentals Are Relevant:

- The United States Natural Gas ETF, LP (NYSEARCA:UNG)

- VelocityShares 3x Inverse Natural Gas ETN (NYSEARCA:DGAZ)

- VelocityShares 3x Long Natural Gas ETN (NYSEARCA:UGAZ)

- ProShares Ultra Bloomberg Natural Gas ETF (NYSEARCA:BOIL)