- Stocks extend slump in afternoon trading as selling takes hold

- S&P 500 posts third dip of at least 5% in the past two months

Jim Paulsen Says This Is Still a Very Vulnerable Marketplace

Spring has sprung -- just not in U.S. stocks, where a harrowing week has walloped traders with echoes of February’s correction.

In the past five years, there have been only two other stretches with losses of this magnitude. The S&P 500 Index is down 6 percent. And the picture looks just as bad for the Dow Jones Industrial Average, which sank to a four-month low by the Friday close. Both indexes suffered their steepest weekly drop in more than two years.

Equities are now teetering near -- and for blue chips, below -- levels seen at the worst point in February’s volatility-fueled meltdown. At the epicenter this time is U.S. President Donald Trump, with his China tariffs driving Boeing Co. down more than 5 percent in a single session on Thursday and losses rippling across industries from technology to banks.

“Investors that have for months relied on Trump’s pro-business rhetoric are now caught off guard,” said Matt Maley, equity strategist at Miller Tabak & Co. “Trade tariffs are a big change and China’s response can even get stronger. There isn’t too much to be optimistic about: investors’ concern associated with Trump’s tariffs isn’t going to be resolved neither next week nor the week after.”

Consider this as a worrying sign of investor fragility: the S&P 500 has closed lower than the midpoint of its daily range for 10 straight days, the longest stretch since at least 1982. That suggests traders are finding reasons to dump shares in the afternoon rather than buy dips.

Friday Slide

Friday was a case in point. The S&P 500 fluctuated for most of the morning before sinking as much as 2.2 percent in the afternoon, coming within 0.2 percent of its Feb. 8 closing low. The Cboe Volatility Index jumped nearly 7 percent to the highest level since early March.

Against the violent moves in equities, other asset classes looked relatively tame. Yields on 10-year Treasuries slipped three basis points on the week, the dollar lost some ground, and gold gained. Oil ignored the risk-off tone, jumping as Trump’s appointment of a new national security adviser heightened the possibility of sanctions against Iran.

But with every sector trading in the red, stock investors had nowhere to hide. Concern over the tariffs on $50 billion of Chinese goods roiled industrial and material companies. China has already hit back, unveiling its own levies on $3 billion of U.S. imports. And its ambassador to the U.S. wouldn’t rule out the possibility of the Asian nation scaling back purchases of Treasuries in response.

Read more about China’s signal on Treasuries here.

Bank of America Corp., the best-performing big bank stock since Trump’s election, tumbled 9.3 percent this week. Facebook Inc. plunged 14 percent in the throes of a privacy scandal, leading tech megacaps lower.

‘Perfect Storm’

“It was the week when one bad thing led to another, it was a perfect storm,” said Jim Paulsen, chief investment strategist at Leuthold Weeden Capital Management. “You took the starch out of the FANGs, you saw banks, industrials, discretionary companies reacting to negative news. What investors are not pricing in is a potential impact on companies’ profit margins.”

The uncertainty around how the tariffs will be implemented has analysts staying quiet on what will happen to earnings. But it’s shaping up as a big risk to watch, given that optimism about the prospects for bumper profits underpinned the market’s jump in January.

Amid all those surprises, the Federal Reserve’s anticipated interest-rate increase on Wednesday almost felt like a side note. But that too has some investors feeling jittery.

Technical Levels

“We saw the Fed talking about two more rate hikes this year, which raises some concerns about the pace of economic expansion,” Paulsen said. “Aggressive forward-looking Fed tightening policy is something the markets will need some time to adjust to. When you combine this with other market concerns, this may be a little too much to take.”

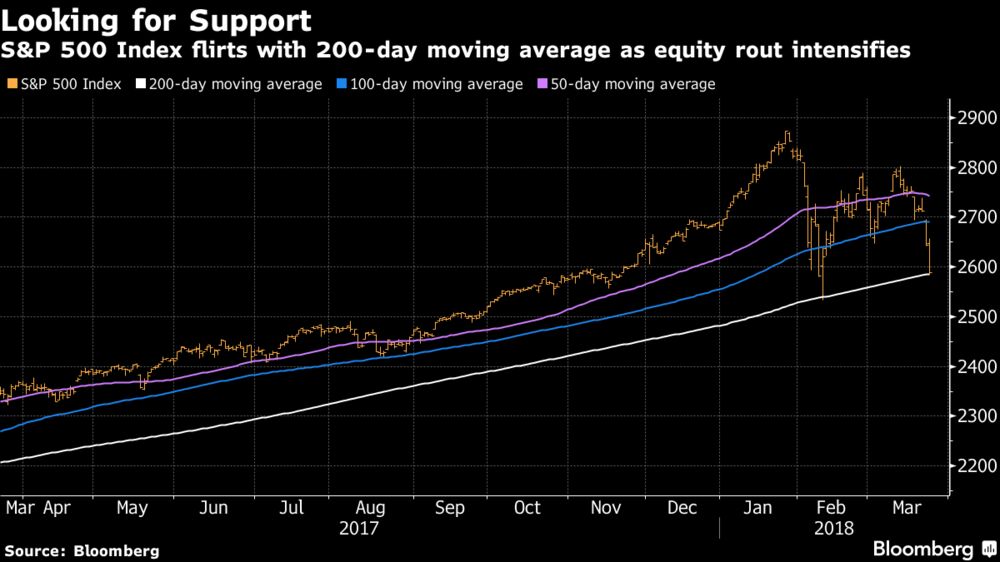

The Dow lost 5.7 percent this week, leaving it almost 5 percent below the level where it was before Congress passed Trump’s sweeping tax overhaul in late December. The S&P 500 closed at 2,588.26, hovering just above its 200-day moving average. Small caps that don’t rely on foreign sales as much as their larger peers did slightly better, sliding 4.8 percent. The Nasdaq 100 Index sank 7.3 percent.

The S&P 500’s decline since March 9 was its third dip of at least 5 percent in two months. Before that, the last time the gauge lost that much was in June 2016 when the U.K. voted to leave the European Union.

“The quiet days are now gone,” said Stephen Carl, head trader at Williams Capital Group. “There are too many things investors have to be worried about.”

— With assistance by Christiana Sciaudone, Felice Maranz, and Lu Wang