| Mega trends in automotive boosting demand for semi |

| 送交者: 2018年02月11日02:52:31 于 [世界军事论坛] 发送悄悄话 |

|

|

Mega trends in automotive boosting demand for semiconductors02 May 2017 The mega trends set to disrupt the automotive industry: electrification, connectivity, mobility and automation, are set to create considerable value chain element growth. The semiconductor industry, in particular, will see demand increase from around $30 billion in 2015 to $42 billion by 2020. China, will continue to sees its share of the total market increase in the mean time. The automotive industry is set to continue to see the sale of new units rise, as car ownership becomes more affordable across Asia. The industry is facing a number of mega trends however; as the globe moves towards a sustainable economy, electrification is set to pick up; while digitalisation is opening up connective car opportunities; mobility considerations, such as car sharing and carpooling too are being created through technological advance and new business models; finally, automation, is set to radically transform the roads, reducing accidents and creating new ownership models. As the mega trends begin to set in, the wider value chain that supports many of the innovations, is likely to see considerable boosts in revenues. In a new report from McKinsey & Company, titled ‘Mobility trends: What’s ahead for automotive semiconductors’, the consultancy firm explores the effects the mega trends will have on semiconductor sales.

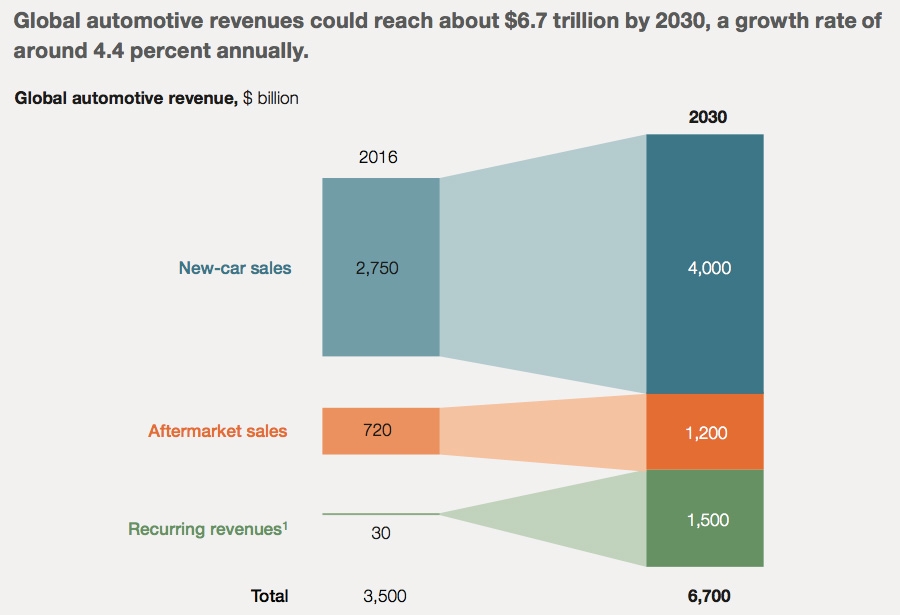

The global revenues derived from the automotive industry is set to grow considerably under the firm’s ‘highly disruptive model’, from $3.5 trillion in 2016 to $6.7 trillion by 2030. The new-car sales segment will continue to represent the largest share by far by 2030, hitting $4 trillion in sales. The aftermarket, which is seeing heated competition, will increase slightly to $1.2 trillion. The recurring revenues segment is set to take off, supported by semiconductors and new operating models within mobility, it will grow from $30 billion in revenues to around $1.5 trillion over the coming 15 years.

The four mega trends affecting the industry are, according to the firm, set to grow the demand for semiconductors in the medium- to long-term. Electric vehicles (EVs) for instance, require more than $1000 in semiconductors to function, hybrids around $900 and more traditional ICE vehicles around $330. Additional connectivity features in vehicles will likely further boost the number of sensors and processors, while automation and the technologies that underpin its potential are heavily semiconductor dependent. The market itself has already been growing steadily, with automotive semiconductor sales up from around $8 billion in the late 1990s, to almost $30 billion by 2015. The industry too has increased its share of the total semiconductor market, up from 5.3% in the late 1990s to 8.2% in 2015.

The research notes that the gains for individual countries will vary somewhat. Japan is likely to miss out on much of the growth, with total sales increasing at around 2% between 2010 and 2020, to $4.4 billion. China will continue to grow its global share of sales in the intervening period, up from 19% in 2015 to 23% by 2020. The country’s semiconductor industry growth, in line with its wider economy, will slow somewhat however, from 15% CAGR between 2010 and 2015 to 10% CAGR between 2015 and 2020. Canada, the US and Mexico will too see a slowdown in semiconductor sales growth for the automotive sector, from 11% over the years prior to 2015 to 6% to the years to 2020. Total sale will be relatively robust however, hitting $10.2 billion by 2020. Europe too will see relatively slow growth between 2010 and 2015, maintaining 6%, growing sales from $6.4 billion to $11.2 billion.

The management consulting firm also looks at the areas of the business that will see the biggest growth spurts over the coming five years. Safety features, a key early development in the automation journey for the industry, will grow its total market share of semiconductors from 17% to 24%, with collision warning generating $4.1 billion more in semiconductor sales, eCall telematics $1.3 billion more and tire-pressure warning technology, $0.6 billion more. Driver info will see its share fall slightly, from 23% to 22%, with navigation and primary instruments up $2.2 billion and $1.9 billion respectively.

In terms of the automotive-semiconductor-device segment, all are found by the firm to see pockets of growth. The optical sensor segment will account 17% of total semiconductor sales by 2020, with image sensors the segment to see the biggest net growth, up by 11% CAGR. Discrete semiconductors will see relatively low levels of growth, with power transistor and thyristor and rectifies & diodes up 5% and 4% CAGR respectively. Analog will represent 29% of total market share, with general purpose and ASIC components growing at 7% and 6% CAGR respectively. Micro-components will be the biggest segment by 2020, with MPU and MCU growing steadily in the coming years, up at 14% and 9% CAGR respectively. NAND, in the memory segment, is the fastest growing of the industry, up 19% CAGR to 2020. |

|

|

|

|

|

|

| 实用资讯 | |

|

|

|

|

| 一周点击热帖 | 更多>> |

|

|

|

| 一周回复热帖 |

|

|

| 历史上的今天:回复热帖 |

| 2017: | 川普重申一中是为了经济上的攻势做准备 | |

| 2017: | 安倍的打手《日本经济新闻》社和《产经 | |

| 2016: | 江南愤青谈香港问题! | |

| 2016: | 朝鲜发射卫星,其实对战略稳定贡献很大 | |

| 2015: | 大陆增加军力 高华柱有对策? | |

| 2015: | 中国巨舰访荷兰遇提问:这么大军舰是租 | |

| 2014: | 东湾一死一伤,Hayward | |

| 2014: | 美媒:美对中国开战越早越好 趁解放军还 | |

| 2013: | 庄则栋病逝 | |

| 2013: | 70万精锐部队被打残:淞沪会战注定惨败 | |

|

|